Recent Blog Post

VAT

Posted by : November 25, 2022 adminVAT in the UK is currently 20%.

Adding VAT

In most shops you go to, or visit online, the prices shown will already include VAT, so the price displayed will be the price you pay at checkout.

Sometimes however, you will see that the price displayed is shown ‘ex VAT’; this means you need to add 20% onto the price shown to find out the total cost you will pay at checkout.

In the example below, we will look at the simplest way to find this price with a calculator:

20% is entered into your calculator as 0.2

Example:

A new laptop costs £800 (ex VAT).

800 x 0.2 = 160

This means that the VAT is £160, and we need to add this onto the amount of the laptop price shown.

£800 + £160 = £960

So the total price, including VAT is £960.

Removing VAT

Calculating the cost before VAT however, is slightly different. To remove VAT from a price, you simply divide the amount by 1.2.

So using the same examples above, if the laptop price is displayed as £960 (inc VAT), to calculate the cost before VAT you would enter

960 / 1.2 = 800

Writing a Cheque

Posted by : November 15, 2022 adminAlthough many of our financial tasks have moved online in recent years, there are still times when you may need to write a cheque, either for a personal or business expense.

To avoid issues for both you and your payees, it is important these are filled out correctly.

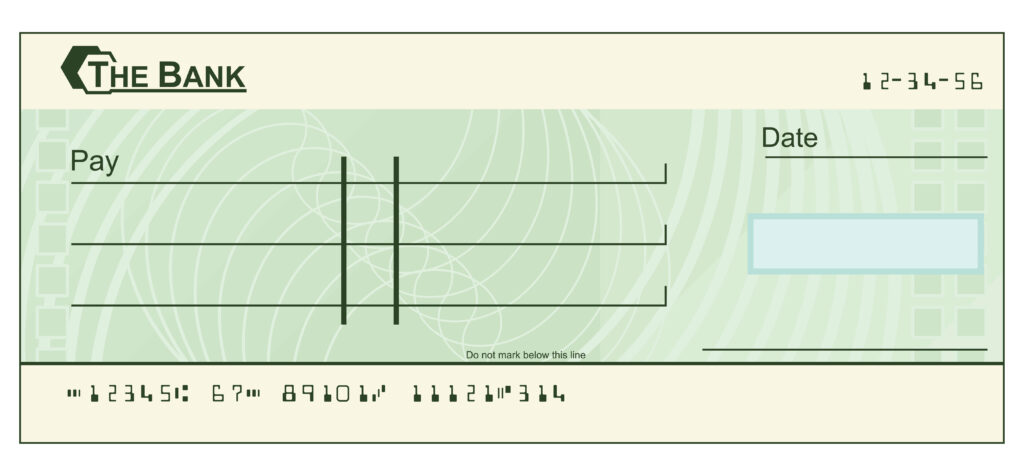

A blank cheque will typically look something like this:

Your bank’s name will be shown at the top.

At the bottom of the cheque you will see a series of numbers – this will be the cheque number (if you flick through your cheque book, you will see they follow in numerical order – e.g the first cheque may be numbered 100101, followed by 100102, etc.), your account number, and sort code.

These details may also be repeated in the top right corner of your cheque.

In the ‘Date’ section, write today’s date – e.g. 21/11/2022.

In the ‘Pay’ section, you need to write the name of the person or company you are paying, followed by the amount you are paying them in Pounds and Pence (if applicable) – written as words, not numbers, followed by the word ‘Only’.

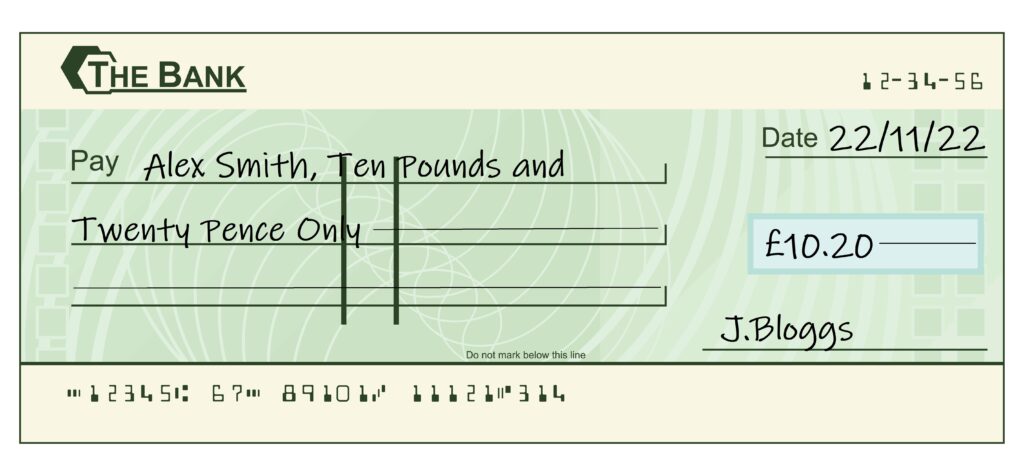

e.g.

for a payment to Alex Smith for £150, you would write:

Alex Smith, One Hundred and Fifty Pounds Only.

For a payment of £10.20, you would write:

Alex Smith, Ten Pounds and Twenty Pence Only.

Below the date box, you will see a blank rectangular box; here you will write the amount you are paying as a number.

It is good practice to put a line through any unused lines which remain in your amount areas – this avoids someone tampering with your cheque and amending it.

On the line below this box, sign your name.

Your completed cheque should look like this:

Remember:

- Always make sure you have sufficient funds before you write a cheque.

- It can take several days for a cheque to clear once the recipient takes it to their bank.

- Cheques are usually valid for up to 6 months from the date they are written – so the recipient does not need to pay it into their bank immediately in order to obtain the money.

Interested in Business and Finance courses?

(0) comments

(0) comments